Article In CHIEF

City’s Medicare plan gets cool Council reception

Posted Wednesday, January 11, 2023 12:19 am

BY RICHARD KHAVKINE

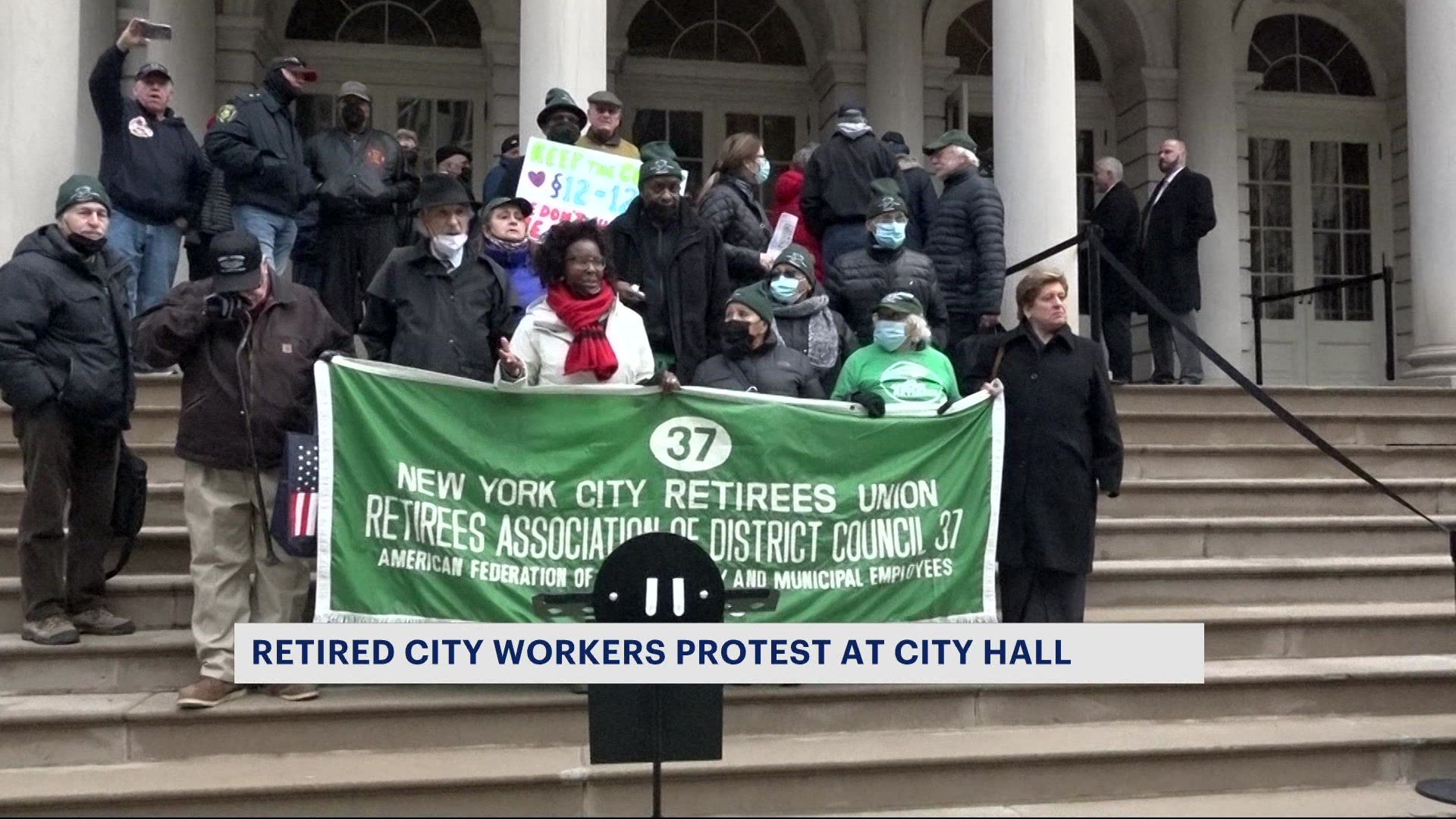

Retired municipal workers will be deprived of choice if the City Council doesn’t sanction a change to the administrative code that allows the city to charge the retirees for a portion of their health care coverage, union leaders and Adams administration officials said Monday.

The retirees and their advocates, though, scoffed at the notion during an all-day hearing of the City Council’s Labor and Civil Service Committee, arguing that any scenario that bills retirees for health insurance would break a covenant established decades ago.

Council members, for their part, voiced skepticism about both the amendment and the city’s increasingly likely switch of retirees from a traditional Medicare program to a private, for-profit Medicare Advantage plan.

“We recognize that this presents an unbearable choice for retirees on fixed incomes and creates a disparate impact on low-income retirees,” Labor Committee Chair Carmen De La Rosa said at the hearing’s outset.

The legislation, which De La Rosa emphasized was not yet scheduled for a vote, would essentially allow the city to bill retirees the difference between a benchmark plan, likely administered by managed-care company Aetna, and any plan that costs more, in this case the retirees’ preferred supplemental plan, GHI Senior Care.

Administration officials have said the legislation, jointly drafted by the Municipal Labor Committee, the umbrella organization of public-sector unions, and the Office of Labor Relations and introduced at the behest of Mayor Eric Adams, would ensure that retirees keep Senior Care. Union and city officials contend the amendment would address a finding by a Manhattan Supreme Court justice who concluded last March that the city’s planned Medicare switch was not legal as constituted since it would require retirees who opted to keep Senior Care to pay for it, which would run against the city code. City officials have said the coverage would cost retirees an additional $191 month and likely more in coming years.

Several union leaders, including Michael Mulgrew, the president of the United Federation of Teachers, and Henry Garrido, the executive director of District Council 37, the city’s largest municipal employees union, are among those supporting the amendment.

“We have allowed fear of the unknown to truly become the perfect enemy of the good,” Garrido said at the hearing. “Amending the administrative code has always been and will always remain about choice.”

Switching to private Medicare and allowing the city to charge for the supplemental plan “may not be popular but they are responsible actions,” said Garrido, whose union represents more than one-third of the 250,000 retirees who would be affected by the Medicare switch, which the city wants to implement in July.

The hearing followed findings last month by Martin Scheinman, the chairperson of a committee tasked with addressing the delivery of health care to municipal workers and retirees, that increased financial deficits attributable to some aspects of the traditional Medicare plan required the city to switch to the private Medicare plan.

Scheinman, who is also an arbitrator, gave the Council until Jan. 29 to amend the administrative code. If it failed to do so, Senior Care will “no longer be an offering,” he wrote.

‘Fiduciary failures’

But the president of the NYC Organization of Public Service Retiree, Marianne Pizzitola, has insisted that the Council is not bound by any of Scheinman’s conclusions, calling it an opinion and not an order. The Council, she said at the hearing, does not have to adhere to “the deadline that’s being forced down your throat,” adding that city officials had “misrepresented” Scheinman’s report.

As she and others have since the planned Medicare switch was first publicized in 2021 during the de Blasio administration, Pizzitola, a retired EMT, has argued that Medicare Advantage plans are vastly inferior to traditional Medicare. The switch and the proposed amendment, the retirees have also said, would renege on assurances made to city workers decades ago.

“You have to remember too, that when we retired, we retired with a promise of something we would have,” Pizzitola said at the hearing.

She said that retired workers who made modest salaries when working and are now earning meager pensions cannot readily come up with an extra $200, as might the presidents of the unions pushing for the amendment.

“I don’t make a $100,000 pension and I shouldn’t be asked to do this for the sake of choice, because for me, for most of them, that’s not a choice,” she said, referring to the retirees.

True choice, she said, would come about as the result of exhaustive research on the part of city officials, which Pizzitola has claimed was not done. “The city has not done its due diligence,” she said. Among what she called “fiduciary failures,” OLR has failed to conduct exhaustive audits of enrollees.

“We’re labor,” she said. “We never believed in privatization of Medicare or health care.”

She chastised the proposed plan as merely an avenue for the union leaders to secure raises for their members. “I shouldn’t be in that position because that’s treating me like cattle,” she said.

“There’s other ways to be able to do this rather than take away people’s health insurance under the guise of giving them choice.”

Assurances don’t suffice

City officials have said switching to the Aetna plan would save the city $600 million a year and $3 billion over the next five years, given a price guarantee from Aetna. It would allow the city to continue to offer premium-free coverage both to current workers and to city retirees, which the Office of Labor Relations’ Daniel Pollak said was increasingly rare as health insurance costs for municipalities and other public entities continue to rise. He said that about half of the nation’s public-sector retirees were covered by Medicare Advantage plans.

Pollak, as administration and MLC officials have contended for months, said the Aetna plan would be equal to or better than the current traditional Medicare plan. Retiree organizations, though, have pushed back on those claims, saying that private providers’ profit motives outweigh consumers’ health concerns. Those apprehensions have been supported by proposals from federal health officials to establish new regulations that would address complaints from consumers, including that some plans could be improperly denying patients’ and doctors’ requests for care.

Claire Levitt, OLR’s deputy commissioner, sought to assuage those concerns during the hearing, saying that city officials are insisting that Aetna’s plan has built-in provisions to ensure superior quality of care. It also will include penalties should the provider not meet standards set by the city and the unions.

For instance, she said the plan would not require referrals to see a specialist. Levitt also said that pre-authorization would not be required for several procedures, including for MRIs, CAT scans and others. “Only about 1 percent of all claims will require prior authorization,” she said. Appeals processes on denials, Levitt said, would be addressed quickly and fairly, according to the working agreement being carved out with the provider.

Levitt’s claims drew sustained laughter from the retirees assembled in the Council Chambers which in turn drew admonitions from De La Rosa against interruptions. About 200 retirees would address the plan during the hearing, which lasted nearly 11 hours.

Several Council members asked to see the city’s agreement with Aetna. Pollak, though, said the agreement’s provisional status made that scenario unlikely, despite Scheinman's direction that the city and the Municipal Labor Committee reach agreement with Aetna on the plan by Monday.

In any case, Pollak said, the city needs to move forward and find ways “to achieve these vital savings." If the amendment is not enacted, he said, Senior Care would be eliminated altogether, as Scheinman also cautioned. Summarizing a finding by Scheinman, Pollak said that failure to implement a Medicare Advantage plan would “inevitably result in co-premiums” for current city employees. “That is not the outcome that the city or the MLC want,” he said.

Under questioning from Council Member Joann Ariola, Pizzitola said she would be willing to sit down with the MLC to discuss alternate funding streams. “We’ve come up with ideas, because you know what, our retirees are attorneys, former OLR, retired OCB,” she said, referring to the city’s Office of Collective Bargaining. “I mean, we ran this city.”

richardk@thechiefleader.com